Consequential Year Yields Unanimous Transformational Budget

Last year, we were just months into the COVID crisis when the budget cycle hit. Much was unknown. One year later, while the crisis is not over, it has at least become significantly clearer which individuals, and which businesses, have faced dramatic impacts due to COVID’s impact on society and the economy—and who needs help.

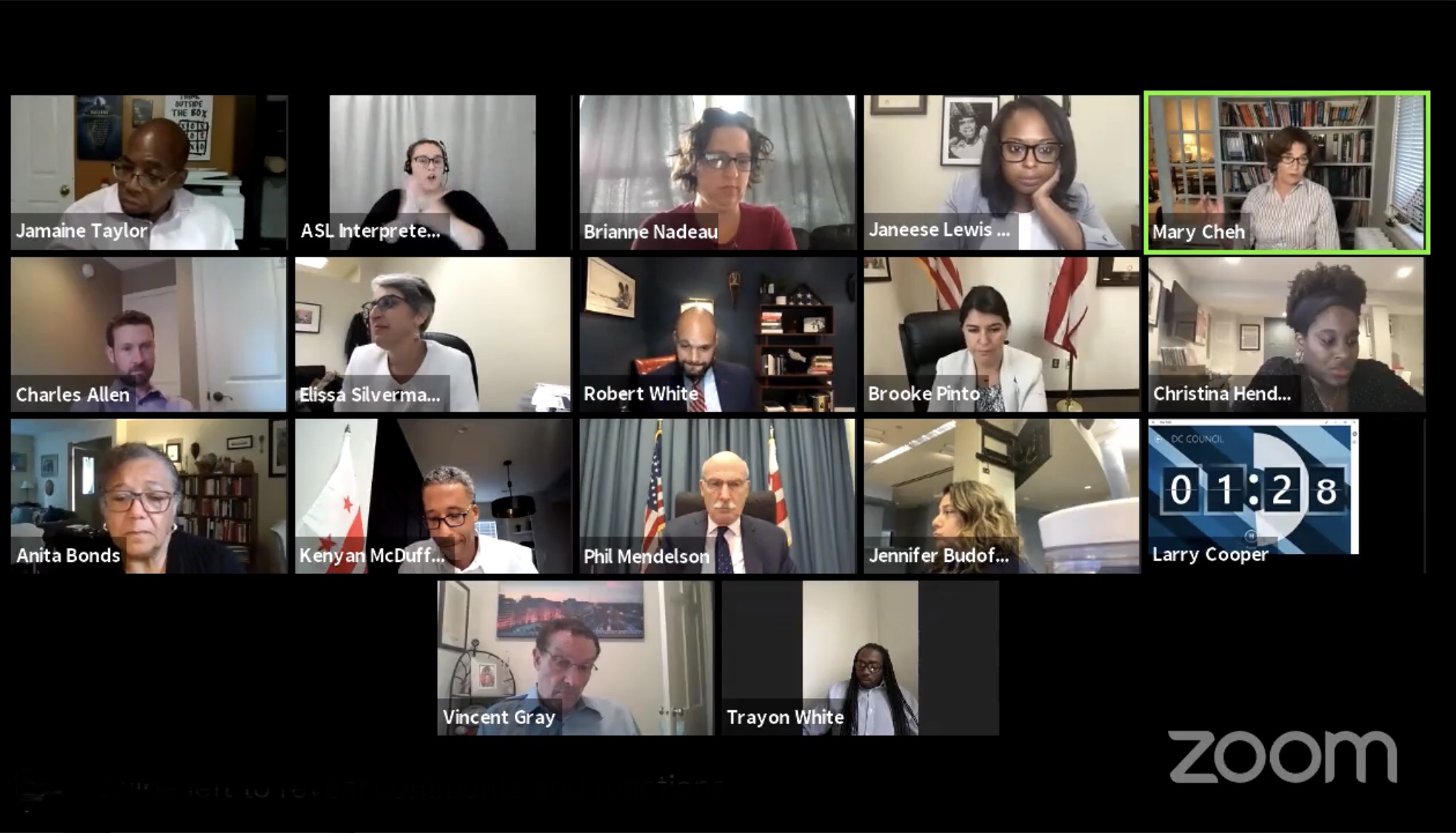

The budget passed unanimously by the Council in the first of two necessary votes at its most recent Legislative Meeting makes significant strides towards addressing the enormous challenge posed by the unique and weighty times we have faced.

As introduced prior to the most recent Legislative Meeting, the Council’s proposed budget included these transformational investments:

- Funding for “Baby Bonds,” which will bank up to $1,000 a year to be provided to low-income youth at age 18 for educational, entrepreneurial, or property ownership uses

- Expansion of Paid Family Leave for medical/self-care from two to six weeks, and taking the initial steps to expand all three categories of Paid Family Leave (parental, family care, and self-care) to 12 weeks

- $50 million in public housing repairs

- $35 million in aid for undocumented and excluded workers ineligible for traditional unemployment insurance

- Expanded funding for Permanent Supportive Housing and Emergency Rental Assistance

- Funding and expanding school-based mental health services to all schools, a critical COVID-era need

- Breaking up the dysfunctional Department of Consumer and Regulatory Affairs into a construction-oriented Department of Buildings and a consumer-oriented Department of Licensing and Consumer Protection

- Pilot funding for the Generating Affordability in Neighborhoods (GAIN) Act, to allow for conversion of unaffordable housing into affordable housing using funded covenants

- Funding for the creation of the Office of the Ombudsperson for Children

- Funding for the creation of the Office on Deaf, DeafBlind, and Hard of Hearing

- Funding for the Deputy Auditor for Public Safety, a recommendation of the Police Reform Commission

- $80 million in additional relief for hotels, restaurant, and small businesses

- Civil legal services for low-income individuals facing eviction and loss of services

- Expansion of the Office of the Attorney General’s Restorative Justice Program

During the course of the meeting, an amendment sought to increase tax rates on higher-income earners in order to fund an expansion of social programs. This effort built on a similar, narrowly unsuccessful effort in the prior budget cycle. The 2020 effort would have increased tax rates on individuals earning over $250,000 from a range of 8.5-8.95% to a range of 8.75-9%, raising $7 million to $12 million per year for four years. The 2021 amendment increased tax rates on individuals earning over $250,000 from a range of 8.5-8.95% to a range of 9.25-10.75%, raising $100 million to $175 million per year for four years.

This expanded second-year amendment was successful, generating substantial additional revenue for social programs. This additional funding will be used to:

- Further expand the introduced bill’s investment in Permanent Supportive Housing and other programs, providing stable housing for over 2,000 residents facing homelessness or precarious housing

- Provide increased wages (exact rates to be determined) to infant and toddler educators at childcare providers

- Expand DC’s Earned Income Tax Credit, and initiate a process whereby the credit will be paid out a a monthly basic income

At the most recent Legislative Meeting, the unanimous votes mentioned above were the first of two necessary votes on the Local Budget Act and the Budget Support Act (the measure that, among other things, puts the dollars-and-cents of the numeric budget into policy terms, in addition to the inclusion of other legislative matters).

In the coming weeks, the Council will hold two Legislative Meetings where the budget will be further discussed and voted on. At its August 3 meeting, the Council will take its second vote on the Local Budget Act, as well as the first and only needed votes on the Federal Portion Budget Request Act and the Local Budget Emergency Adjustment Acts (supplemental FY 2021 bill). At its August 10 meeting, the Council will take its second vote on the Budget Support Act.